Best Wisconsin SR-22 Insurance in 2026 (See the Top 10 Companies Here)

State Farm, American Family, and Geico are the best Wisconsin SR-22 insurance providers, with rates starting as low as $16 per month. State Farm provides competitive basic coverage through its Milwaukee network of local agents.

American Family provides multiple discount programs, and Geico is strong on usage-based savings through its telematics program. SR-22 insurance is required in Wisconsin for drivers with violations like DUIs, driving without insurance, or multiple traffic infractions, and it typically lasts three years.

| Company | Rank | UBI Savings | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Reliable Service | State Farm | |

| #2 | 20% | A | Discount Options | American Family | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 30% | A+ | Flexible Discounts | Progressive | |

| #5 | 40% | A+ | Comprehensive Coverage | Allstate | |

|

#6 | 40% | A+ | Customizable Plans | Nationwide |

| #7 | 15% | A | Immediate Support | Farmers | |

| #8 | 30% | A++ | Military Focus | USAA | |

|

#9 | 30% | A | Tailored Policies | Liberty Mutual |

| #10 | 20% | A++ | Broad Coverage | Travelers |

DUI or DWI convictions have increased premiums compared to drivers with clean records, though many insurers offer discounts to help offset costs. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

What You Should Know

- State Farm leads with its extensive Wisconsin agent network

- American Family offers unique savings through flexible payment programs

- Geico delivers competitive rates at $23 monthly for minimum coverage

#1 - State Farm: Top Overall Pick

Pros

- Competitive Basic Coverage: Minimum coverage starting at $21 monthly for Wisconsin SR-22 insurance requirements.

- Local Agent Network: While our State Farm car insurance review highlights their extensive agent network, this proves especially valuable for SR-22 insurance assistance in Wisconsin.

- Multiple Discount Programs: Wisconsin SR-22 insurance savings through safe driver, continuous coverage, and homeownership discounts.

Cons

- Higher Full Coverage Rates: Premium costs for comprehensive SR-22 insurance in Wisconsin increase significantly for high-risk drivers.

- Strict Eligibility Rules: May deny affordable SR-22 insurance coverage for severe violations in Wisconsin and surrounding areas.

#2 - American Family: Best for Discount Options

Pros

- Affordable Monthly Rates: For Wisconsin drivers, basic SR-22 coverage starts at $22 monthly.

- Extensive Discount Options: Multiple SR-22 insurance savings in Wisconsin through bundling and payment programs.

- Regional Expertise in Wisconsin: Our review of American Family car insurance confirms that they know their local SR-22 requirements and support services well.

Cons

- Limited Coverage Area: In some regions of Wisconsin, SR-22 insurance may be available, but it could be limited.

- Complex Claims Process: SR-22 insurance claims in Wisconsin take more time and require a lot of paperwork.

#3 - Progressive: Best for Flexible Discounts

Pros

- Usage-Based Savings: Snapshot program monitoring offers additional SR-22 Wisconsin insurance discounts.

- Flexible Payment Options: In our Progressive car insurance review, we explain how their SR-22 insurance flexible payment plans are perfect for high-risk drivers in Wisconsin.

- Instant Filing Service: Electronic Wisconsin SR-22 insurance submission within one business day.

Cons

- Higher Initial Costs: SR-22 insurance in Wisconsin may require a lot of down payment compared to normal policies.

- Rate Fluctuations: Driving patterns can lead to Wisconsin SR-22 insurance premiums skyrocketing.

#4 - Allstate: Best for Comprehensive Coverage

Pros

- Extensive Protection: Our Allstate car insurance review found that Allstate offers many coverage options for Wisconsin drivers, especially for SR-22 filers.

- Local Agency Support: Dedicated Wisconsin SR-22 insurance agents providing personalized filing assistance.

- Accident Forgiveness: First-time incident forgiveness for Wisconsin SR-22 insurance policyholders.

Cons

- Premium Rates: Higher SR-22 insurance Wisconsin costs compared to basic coverage providers.

- Strict Requirements: Stringent eligibility criteria for Wisconsin SR-22 insurance discount programs.

#5 - Nationwide: Best for Customizable Plans

Pros

- Tailored Coverage: Wisconsin SR-22 insurance plans can be customized for particular driving restriction needs.

- Multiple Discounts: Our Nationwide car insurance review, explains their wide range of SR-22 insurance discount programs for high-risk drivers in Wisconsin.

- Online Resources: Implementing an efficient management of Wisconsin SR-22 insurance policies using complex digital tools.

Cons

- Coverage Gaps: Limited SR-22 insurance options in certain Wisconsin regional areas.

- High Base Rates: More expensive SR-22 insurance Wisconsin minimum coverage starting rates.

#6 - Farmers: Best for Immediate Support

Pros

- Quick Processing: Fast SR-22 insurance Wisconsin filing with immediate coverage verification services.

- 24/7 Support: Our Farmers car insurance review shows their commitment to round-the-clock SR-22 assistance for policyholders in Wisconsin.

- Forgiveness Programs: Accident forgiveness options for Wisconsin SR-22 insurance policyholders.

Cons

- Limited Discounts: Fewer SR-22 insurance savings opportunities compared to other Wisconsin providers.

- Regional Pricing: Higher SR-22 insurance costs in Wisconsin metropolitan areas.

#7 - Liberty Mutual: Best for Tailored Policies

Pros

- Customized Coverage: Our car insurance review of Liberty Mutual emphasizes their flexible Wisconsin SR-22 policy customization options.

- RightTrack Program: Usage-based SR-22 insurance discounts through driving behavior monitoring in Wisconsin.

- Multi-Policy Benefits: Bundling options for Wisconsin SR-22 insurance with other coverage types.

Cons

- Higher Premiums: More expensive SR-22 insurance rates in Wisconsin urban areas.

- Complex Claims: Lengthy Wisconsin SR-22 insurance claim processing and documentation requirements.

#8 - USAA: Best for Military Focus

Pros

- Military Benefits: Our USAA car insurance review details their exceptional military-focused Wisconsin SR-22 coverage options.

- Competitive Rates: The lowest Wisconsin SR-22 insurance minimum coverage is $16 monthly.

- Quality Service: Top-rated Wisconsin SR-22 insurance claims handling and customer support.

Cons

- Membership Restricted: SR-22 insurance is limited to military members and families in Wisconsin.

- Limited Offices: Minimal physical SR-22 service locations in Wisconsin.

#9 - Travelers: Best for Broad Coverage

Pros

- Wide Coverage: According to our Travelers car insurance review, their broad SR-22 coverage options suit various risk levels for drivers in Wisconsin.

- IntelliDrive Program: Smart technology discounts for Wisconsin SR-22 insurance policyholders.

- Multiple Packages: Various Wisconsin SR-22 insurance coverage levels for different needs.

Cons

- Limited Availability: Restricted SR-22 insurance access in certain Wisconsin regions.

- Price Variations: Inconsistent SR-22 insurance Wisconsin rates across coverage areas.

#10 - Erie: Best for Regional Support

Pros

- Personalized Service: Regional focus ensures tailored SR-22 insurance Wisconsin assistance.

- Flexible Coverage: As mentioned in our Erie insurance reviews, they have adaptable SR-22 insurance Wisconsin options for various violation types.

- Rate Lock Program: Stable Wisconsin SR-22 insurance premium options for qualified drivers.

Cons

- Geographic Limitations: SR-22 insurance coverage is restricted to specific Wisconsin areas.

- Qualification Requirements: Strict Wisconsin SR-22 insurance eligibility standards for high-risk drivers.

How Much is SR-22 Insurance in Wisconsin

If you must file an SR-22 form in Wisconsin, you have been in trouble for a driving offense. The state or a court has ordered you to submit this form to the Wisconsin Department of Transportation. The SR-22 proves that you have insurance meant for those deemed high-risk. Your insurance company will handle the filing for you.

When comparing SR-22 insurance Wisconsin providers, costs vary significantly. USAA offers the lowest rates at $16 monthly for minimum coverage, while State Farm and American Family follow at $21 and $22, respectively. However, for SR-22 insurance Wisconsin quotes, remember that rates in urban areas like Milwaukee may be higher than state averages.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $43 | $123 | |

| $22 | $63 | |

| $38 | $109 | |

| $23 | $62 | |

|

$30 | $85 |

|

$80 | $227 |

| $33 | $94 | |

| $21 | $59 | |

| $26 | $73 | |

| $16 | $47 |

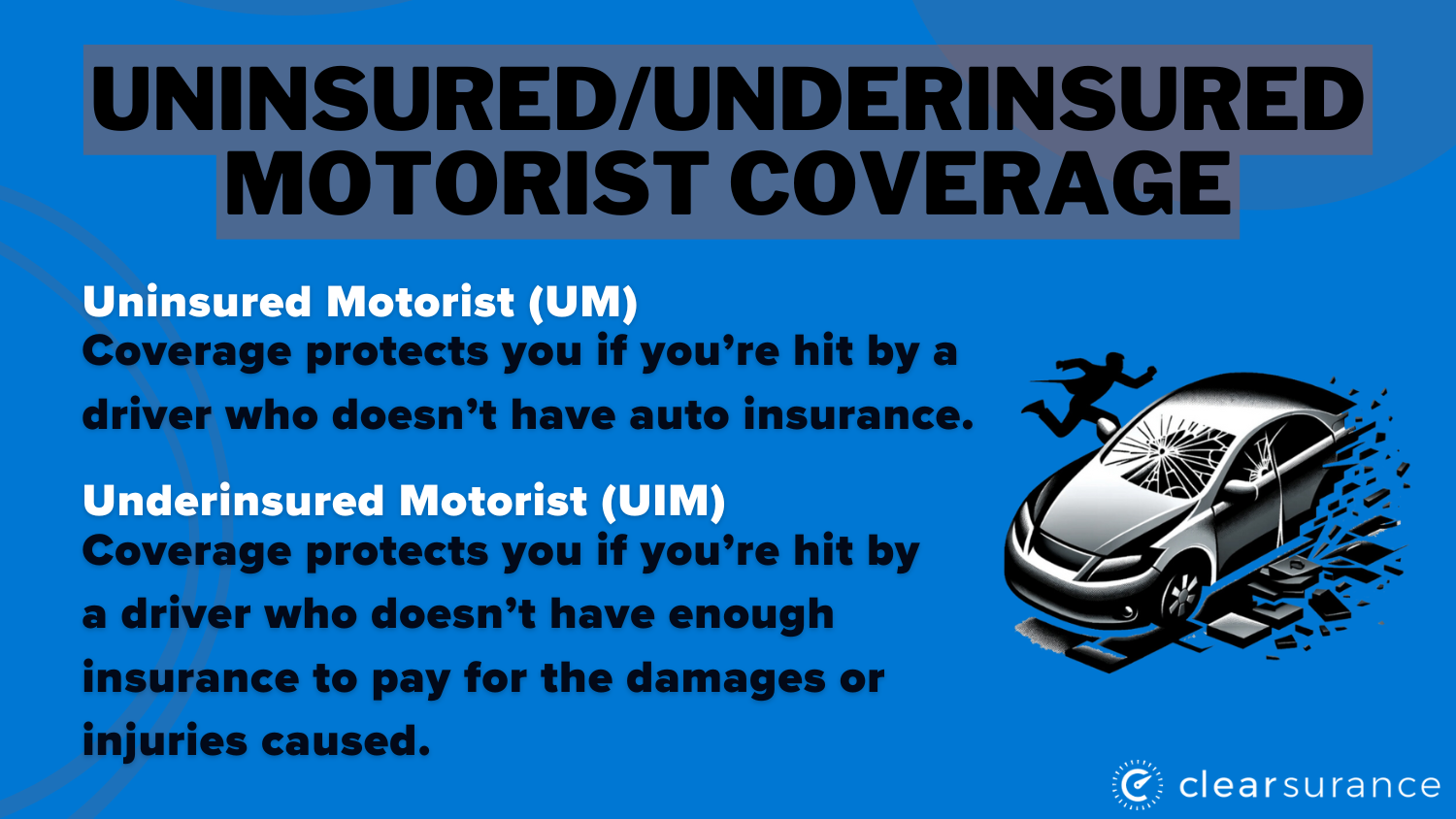

While shopping for SR-22 insurance quotes in Wisconsin, you must meet minimum coverage requirements of $25,000/$50,000 for bodily injury and $10,000 for property damage, plus matching uninsured/underinsured motorist coverage.

The SR-22 must be filed for three years, and it's important to keep your insurance active during that time. If you let your coverage lapse, you could lose your license and face extra penalties. To find the most competitive SR-22 insurance Milwaukee rates, it's recommended that you compare quotes from multiple insurers.

Wisconsin SR-22 Insurance Market Analysis

Knowing how SR-22 insurance works in Wisconsin is important for understanding how much it will cost and what’s required. Let’s break down some of the most important metrics that affect your SR-22 insurance across the state.

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Rear-end Collision | 35% | $5000 |

| Intersection Accident | 25% | $4200 |

| Parked Vehicle Damage | 15% | $2800 |

| Single Vehicle Accident | 15% | $6500 |

| Theft | 10% | $7000 |

When you’re looking to get SR-22 insurance in Wisconsin, knowing how the provider performed on key metrics in their market can help you make sure that they’ll still be there when you need them.

| Category | Grade | Explanation |

|---|---|---|

| Overall Affordability | A | Wisconsin’s premiums are below the national avg. |

| Customer Satisfaction | A | High satisfaction ratings across major providers |

| Claims Processing Speed | B | Generally quick but varies by provider |

| Available Discounts | B | Variety of discounts offered by major insurers |

| Financial Strength | C | Some smaller providers have lower ratings |

High-risk drivers should prioritize providers with strong financial ratings and comprehensive coverage options to maintain continuous SR-22 compliance and avoid potential coverage gaps. Where you are matters in SR-22 insurance. In the city, the numbers climb higher. More incidents mean higher premiums.

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Green Bay | 900 | 700 |

| Kenosha | 750 | 600 |

| Madison | 1,500 | 1,200 |

| Milwaukee | 2,400 | 1,800 |

Wisconsin S-R22 insurance rates depend on claim history, provider reliability and location. The best thing to do is to search for stable insurers with continuous coverage options in their area.

Wisconsin SR-22 Insurance Requirements & Discount Options

In Wisconsin, SR-22 insurance is required for various violations, including DUIs, driving without insurance, license suspensions, or multiple traffic violations.

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Safe Driver Discount | A | 20% | State Farm, Allstate, Progressive |

| Multi-Policy Discount | A | 15% | State Farm, Geico, Nationwide |

| Good Student Discount | B | 10% | Allstate, Liberty Mutual, Farmers |

| Defensive Driving Course | B | 8% | Progressive, Nationwide, American Family |

| Early Signing Discount | C | 5% | Geico, Travelers |

This high-risk insurance requirement particularly affects drivers in Milwaukee, Wauwatosa, and surrounding areas, typically resulting in higher premiums. After a DUI conviction, Wisconsin drivers pay 70% more than those with clean records. (Read More: What Is Considered a Clean Driving Record?)

Bundlé and savé your way with the Personal Price Plan®. pic.twitter.com/Y5w8kZ5hxi

— State Farm (@StateFarm) October 1, 2024

To help offset these increased costs, many insurance providers offer various discounts to SR-22 filers. Here's a comprehensive breakdown of available discounts from major insurers:

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Safe Driver, Defensive Driving Course, Good Student, Loyalty Discount, Low Mileage, Auto Safety Equipment. | |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Homeowner, Pay-In-Full, Alternative Fuel. | |

| Multi-Policy, Good Driver, Seatbelt Use, Defensive Driving, Vehicle Safety Equipment, New Vehicle, Anti-Theft Device. | |

| Multi-Policy, Good Driver, Anti-Theft Device, New Car, Homeowner, Paperless, Pay-In-Full. | |

|

Multi-Policy, Defensive Driving Course, Safe Driver, Anti-Theft Device, Accident-Free, Automatic Payments, Paperless. |

|

Multi-Policy, Homeowner, Safe Driver, Continuous Insurance, Good Student, Snapshot (usage-Based Discount). |

| Multi-Policy, Safe Driver, Defensive Driving Course, Anti-Theft Device, Accident-Free, Vehicle Safety. | |

| Multi-Policy, Safe Driver, Hybrid Vehicle, Continuous Insurance, Good Student, New Car, Homeownership. | |

| Multi-Policy, Safe Driver, Defensive Driving Course, Vehicle Storage, Annual Mileage, Military Garaging. | |

| Multi-Policy, Homeowner, Safe Driver, Continuous Insurance, Good Student |

To obtain SR-22 insurance in Wisconsin, you must work directly with an insurance carrier, as you cannot file independently. The filing period is typically three years, and continuous coverage is mandatory to avoid license suspension.

Finding the Best Wisconsin SR-22 Insurance

The best Wisconsin SR-22 insurance providers include State Farm, American Family, and Geico. State Farm boasts the most local agent network for personalized service, American Family offers multiple discounts programs, including bundling and payment options, and Geico offers the best usage-based car insurance savings through its telematics program.

The average cost of SR-22 insurance in Wisconsin ranges from $16 to $80 monthly for minimum coverage. USAA offers the lowest rates at $16 monthly for military members and State Farm following at $21 monthly. Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

Frequently Asked Questions

How do you file SR-22 documentation in Wisconsin?

To file an SR-22 insurance claim in Wisconsin, contact your car insurance provider and request an SR-22. The insurer files it with the Wisconsin DMV, certifying you have the required liability coverage. Wisconsin SR-22 insurance quotes outline the SR-22 insurance cost in Wisconsin, which varies based on your driving history.

Who needs SR-22 insurance in Wisconsin?

SR-22 insurance is needed for drivers with violations like DUI/DWI, driving without car insurance, or multiple offenses. High-risk drivers require high-risk insurance in Wisconsin, and an SR-22 proves you meet the state’s minimum coverage requirements.

How long do I need SR-22 insurance in Wisconsin?

In Wisconsin, most drivers need SR-22 insurance for three years. Letting your policy lapse extends the Wisconsin DMV SR-22 requirement and may lead to license suspension. Maintaining continuous coverage avoids penalties.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

How much will an SR-22 increase my insurance?

SR-22 insurance increases premiums due to being high-risk insurance in Wisconsin. Costs vary based on your record and insurer. On average, premiums may increase by 50% or more. Comparing Wisconsin SR-22 insurance quotes helps find affordable options.

Who has the cheapest SR-22 insurance?

The cheapest SR-22 insurance providers vary by situation. Companies like Progressive and Geico often offer affordable SR-22 insurance costs in Wisconsin. Comparing Wisconsin SR-22 insurance quotes is crucial to finding the best rates.

How much is full coverage SR-22 insurance?

Full coverage SR-22 insurance includes liability and comprehensive coverage. The cost of full coverage SR-22 insurance in Wisconsin ranges from $16 to $250 per month, depending on factors like driving history and location, such as car insurance in Milwaukee.

Read More: Cheap Full Coverage Car Insurance

What does an SR-22 look like?

An SR-22 is a form filed by your insurer with the Wisconsin DMV SR-22 department, not an insurance policy. It contains your details and proof of meeting state liability requirements. You won’t receive a physical form but a filing confirmation from your insurer.

How can I get Wisconsin SR-22 insurance quotes?

Contact multiple insurers to get Wisconsin SR-22 insurance quotes and provide accurate driving information. Some specialize in high-risk insurance in Wisconsin and offer competitive quotes for SR-22 coverage.

Can I get SR-22 insurance if I don't own a car in Wisconsin?

Non-owner SR-22 insurance is available if you don’t own a car but must meet the Wisconsin DMV SR-22 requirement. It provides liability coverage for driving borrowed or rented cars and is generally cheaper than owner SR-22 policies.

Read More: Cheap Non-Owner Car Insurance

What is the average SR-22 insurance cost in Wisconsin?

Wisconsin's average SR-22 insurance cost varies by age, location, and driving history. Car insurance in Milwaukee may cost more due to higher traffic. Compare Wisconsin SR-22 insurance quotes to find the best rate.

Find cheap car insurance quotes by entering your ZIP code.