Best Washington SR-22 Insurance in 2026 (Top 10 Companies Ranked)

For the best Washington SR-22 insurance, Nationwide, Progressive, and Allstate emerge as leading providers, with rates starting as low as $20 per month. Nationwide stands out with an industry-leading 40% safe driver discount, Progressive offers unique rate reductions every 6 months, and Allstate provides digital compliance tracking with automatic renewal alerts.

Most drivers must maintain coverage for at least three years, and monthly premiums for full coverage range from $20 to $50, depending on violation type and provider.

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

|

#1 | 40% | A+ | Affordable Rates | Nationwide |

| #2 | 30% | A+ | Broad Coverage | Progressive | |

| #3 | 30% | A+ | UBI Savings | Allstate | |

| #4 | 30% | A | Customizable Options | Farmers | |

| #5 | 25% | A++ | Military Discounts | Geico | |

| #6 | 30% | A++ | Member Benefits | USAA | |

|

#7 | 30% | A | Flexible Payments | Liberty Mutual |

| #8 | 30% | B | Strong Reputation | State Farm | |

| #9 | 30% | A++ | Innovative Discounts | Travelers | |

| #10 | 30% | A | Loyalty Rewards | American Family |

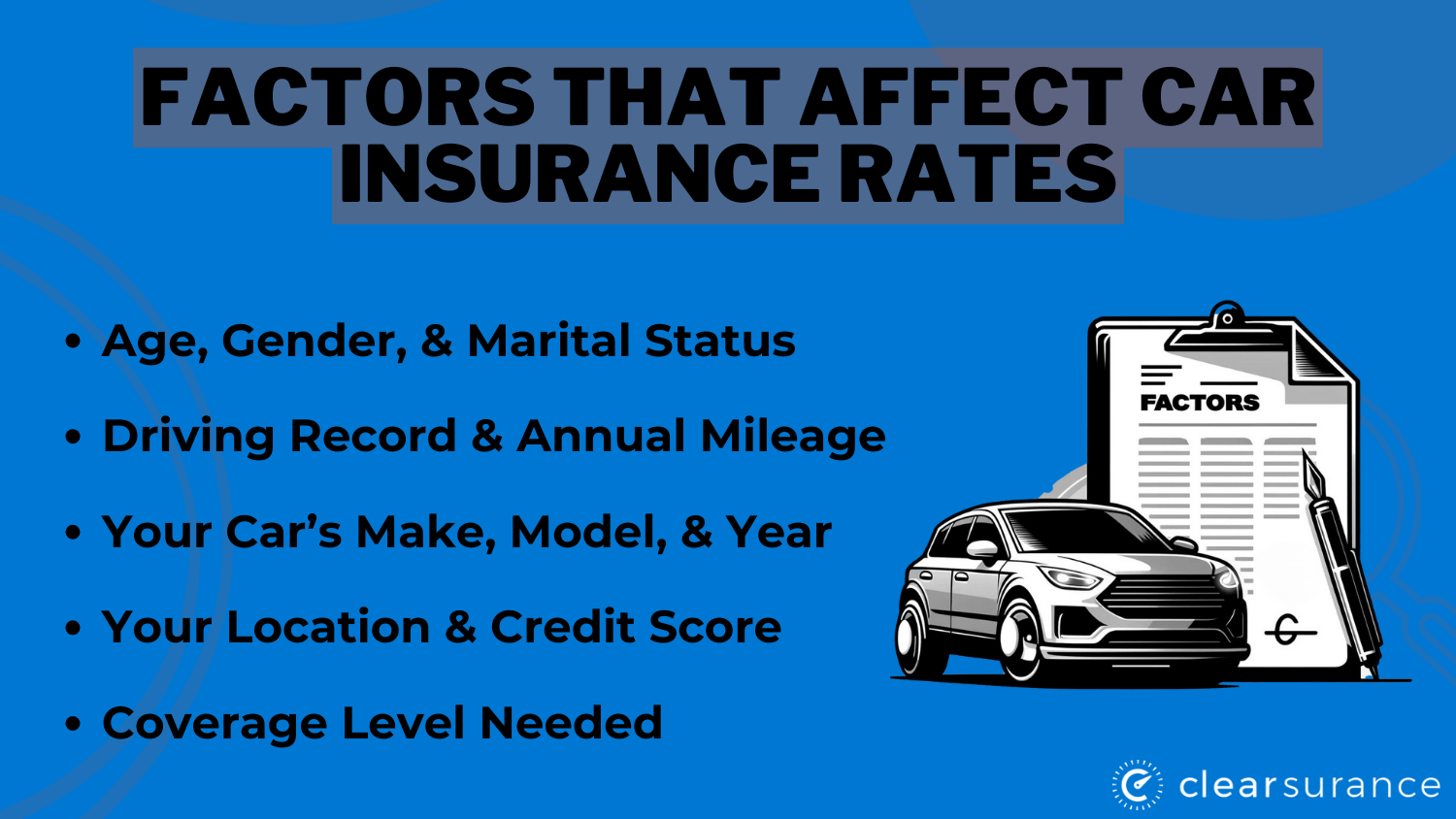

To find affordable SR-22 coverage in Washington, drivers should compare quotes and explore discounts. The cost of car insurance varies by driving history, location, and vehicle type.

By entering your ZIP code, you can get instant car insurance quotes from top providers.

What You Should Know

- Nationwide offers an industry-leading 40% safe driver discount

- SR-22 is required for three years after serious violations in Washington

- Progressive's unique 6-month rate reduction program

#1 – Nationwide: Top Overall Pick

Pros

- Lowest SR-22 Filing Fee: Only $15 filing fee in Washington state, making it the most affordable option as detailed in our Nationwide insurance review for budget-conscious drivers seeking minimal costs.

- Quick SR-22 Processing: Same-day filing with Washington DOL, ensuring immediate compliance and stress-free verification while minimizing documentation processing delays.

- SR-22 Rate Reduction: Up to 40% discount after 1 year of safe driving with SR-22 in Washington, significantly reducing long-term premium costs and rewarding responsible driving behavior.

Cons

- SR-22 Monitoring: Strict compliance checks may lead to higher rates for minor violations in Washington, requiring extra vigilant driving habits and constant awareness of driving record.

- Limited SR-22 Support: Fewer specialized agents for SR-22 cases in Washington, potentially causing longer wait times for assistance and reduced accessibility to expert guidance.

#2 – Progressive: Best for Broad Coverage

Pros

- SR-22 Price Tool: Compare Washington SR-22 rates instantly online, as outlined in our Progressive insurance review, helping drivers find best available deals.

- SR-22 Duration Discount: Rates decrease every 6 months of maintained SR-22 insurance in Washington, rewarding consistent safe driving records with substantial premium reductions.

- Flexible SR-22 Filing: Multiple options for Washington state filing requirements, accommodating various driver circumstances and needs while providing customizable payment solutions.

Cons

- SR-22 Transfer Fees: Washington policyholders switching from another provider will have additional costs, which should be carefully planned for and could cause upfront expenses to increase.

- High-Risk Premiums: Steep SR-22 rates for severe driving violations in Washington, particularly impacting DUI offenders and those with multiple infractions.

#3 – Allstate: Best for UBI Savings

Pros

- SR-22 Monitoring App: Digital tracking of SR-22 compliance status for Washington policyholders, as detailed in our Allstate insurance review, providing convenient real-time updates.

- SR-22 Renewal Alerts: Automatic notification of Washington filing due date expiration, preventing costly lapses in coverage and continued compliance.

- Washington SR-22 Violation Protection: After minor infractions, it maintains coverage, giving additional security and stability at the cost of never being cancelled without warning.

Cons

- SR-22 Base Rates: Higher initial SR-22 filing costs in Washington, requiring substantial upfront financial commitment and potentially straining household budgets.

- Strict SR-22 Terms in Washington: Maintaining coverage requires strict compliance and tight attention to detail, while the flexibility to change policies is quite limited.

#4 – Farmers: Best for Customizable Options

Pros

- Custom SR-22 Plans: Tailored coverage options for different violation types for drivers in Washington, as explained in our Farmers car insurance review, providing flexible solutions for various situations.

- SR-22 Bundling: Significant savings when combining home and SR-22 insurance in Washington, maximizing discount potential while maintaining comprehensive coverage across multiple policies.

- Local SR-22 Support: Washington State agents focused on adding personal touch to every step of the filing process to ensure that filing an SR-22 is a simple and straightforward matter.

Cons

- SR-22 Documentation: Extensive paperwork for Washington state compliance, requiring significant time investment and attention to complex filing requirements.

- Limited SR-22 Payment Plans: Washington high-risk drivers have fewer installment options that may result in a financial strain that has limited payment flexibility.

#5 – Geico: Best for Member Benefits

Pros

- Great SR-22 Rates: Special pricing for members requiring SR-22 in Washington, detailed in the Geico car insurance review, offering competitive premiums with additional membership perks.

- SR-22 E-Filing: Electronic submission to Washington DOL right away, speeding up the process of filing and verifying and processing the document as soon as possible.

- 24/7 SR-22 Support: Round-the-clock assistance with Washington filing requirements, providing constant access to help and guidance whenever needed.

Cons

- Washington SR-22 Coverage Limits: Restricted policy modifications while under SR-22, limiting flexibility in coverage adjustments and customization options.

- Basic SR-22 Service: High risk drivers in Washington will find minimal additional benefits lacking some premium features of a standard policy.

#6 – USAA: Best for Military Discounts

Pros

- Military SR-22 Expertise: Our USAA car insurance review highlights their specialized handling of Washington SR-22 for service members, providing tailored solutions for military personnel.

- Washington SR-22 Rate Protection: Minimal increases for deployment-related filing gaps, ensuring continued coverage during military service with minimal financial impact.

- Fast SR-22 Processing: Washington state requirements are prioritized, with the ability to expedite documentation and verification to quickly activate policy.

Cons

- Washington SR-22 Eligibility: Military connection required for coverage, limiting accessibility to specific demographic groups and their immediate families.

- Limited SR-22 Options: Some violations for Washington drivers may limit the types of coverage that are available, which could limit what a driver has for comprehensive protection.

#7 – Liberty Mutual: Best for Flexible Payments

Pros

- SR-22 Installments: Multiple payment options for Washington filing fees, as detailed in our car insurance review of Liberty Mutual, offering flexible payment schedules to fit various budgets.

- SR-22 Mileage Pricing: Washington SR 22 offers usage based rates on SR 22 for limited driving, allowing occasional drivers to save money using different pricing models.

- Flexible Washington SR-22 Terms: An adjustable coverage period above state minimums so that drivers can pick and choose what level of protection they want based on individual needs and situations.

Cons

- SR-22 Rate Consistency: Variable pricing between online and Washington agent quotes, creating potential confusion and requiring thorough comparison shopping.

- High SR-22 Down Payment: Larger initial deposit for Washington policies, potentially straining immediate financial resources with substantial upfront costs.

#8 – State Farm: Best for Strong Reputation

Pros

- Dedicated Washington SR-22 Agents: Personal assistance throughout the filing process, explained in our State Farm car insurance review, providing individualized support and expert guidance.

- SR-22 Renewal Support: Providing proactive management of Washington requirements, along with continuous coverage and timely reminder for assistance.

- SR-22 Rate Counseling: Offers counsel on what Washington state drivers needs to improve rates after violations, in the form of personalized advice for long term premium reduction strategies.

Cons

- SR-22 Tech Interface: An outmodel digital platform and lacking in user friendly features for filing management in Washington.

- Conservative SR-22 Rates: Higher premiums for serious violations for Washington policyholders, particularly impacting drivers with multiple infractions or severe violations.

#9 – Travelers: Best for Innovative Discounts

Pros

- Washington SR-22 Education Credit: Rate reductions for completing safety courses, as highlighted in our Travelers car insurance review, rewarding proactive learning and skill improvement.

- SR-22 Early Filing: Unique promotional discounts for Washington proactive compliance, rewarding responsible behavior with premium savings.

- SR-22 Hybrid Savings: Provides lower SR-22 insurance rates on eco friendly cars, remaining environmentally conscious while also getting the best rates possible.

Cons

- SR-22 Transfer Process: Complex procedures when switching carriers in Washington, requiring extensive documentation and potentially delayed coverage transitions.

- Limited SR-22 Forgiveness: Strict violation policies while under filing, offering minimal leniency for minor infractions or technical violations in Washington.

#10 – American Family: Best for Loyalty Rewards

Pros

- Washington SR-22 Loyalty Benefits: Our review of American Family car insurance highlights their rate improvements for maintained compliance and long-term customer commitment.

- SR-22 Family Pricing: SR-22 discounts offered for multi-vehicle households in Washington, despite having SR-22 status.

- SR-22 Milestone Rewards: Rates that decrease on Washington policyholder filing anniversary dates, with progressive benefits for maintaining policy.

Cons

- SR-22 Application Length: Processing time of new filings in Washington can be extended, meaning that coverage activation and verification can be delayed.

- Restricted SR-22 Changes: Limited mid-term policy adjustments in Washington, reducing flexibility for coverage modifications during the policy period.

SR-22 Insurance in the State of Washington

To find the best Washington SR-22 insurance, you must know what the state requires you to have and what coverage options there are. The minimum liability coverage required by the state is $25,000 for bodily injury per person, $50,000 per accident, and $10,000 for property damage. Here's the monthly rates comparison between basic and full coverage:

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $114 | |

| $40 | $91 | |

| $44 | $102 | |

| $32 | $75 | |

|

$40 | $92 |

|

$30 | $70 |

| $26 | $60 | |

| $30 | $69 | |

| $35 | $81 | |

| $20 | $46 |

SR-22 insurance costs in Washington state vary significantly, with full coverage rates depending on what kind of car insurance you really need and your driving record. This table presents the annual number of traffic accidents and resulting insurance claims across major cities in Washington state.

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bellevue | 2,000 | 1,700 |

| Bellingham | 1,200 | 1,000 |

| Everett | 1,800 | 1,500 |

| Kent | 1,600 | 1,350 |

| Renton | 1,400 | 1,150 |

| Seattle | 15,000 | 12,500 |

| Spokane | 4,500 | 3,800 |

| Tacoma | 4,000 | 3,400 |

| Vancouver | 3,200 | 2,800 |

| Yakima | 1,500 | 1,200 |

Most companies require SR-22 coverage for at least three years without any lapses. For those without vehicles, non-owner SR-22 in Washington state is available and required if you've committed violations while driving rental or borrowed cars.

For example, the table below shows how often and at what average cost Washington residents file the most common auto insurance claims.

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Windshield Damage | 30% | $400 |

| Rear-End Collisions | 29% | $3,000 |

| Vandalism | 15% | $1,500 |

| Single-Vehicle Accidents | 10% | $10,000 |

| Intersection Accidents | 8% | $20,000 |

Washington’s key providers, such as Nationwide, offer electronic filing with the Washington Department of Licensing (DOL), which keeps you in compliance with state requirements immediately, but also offers flexible payment options to help you absorb the increased premium costs.

How to Save on Washington SR-22 Insurance

When searching for the cheapest SR-22 insurance in Washington state, several providers offer unique savings opportunities despite their high-risk status.

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Good Driver | A | 30% | Geico, State Farm, Progressive, Nationwide |

| Multi-Vehicle | A | 25% | Geico, State Farm, Progressive, Nationwide |

| Bundling | A | 20% | Geico, State Farm, Progressive, Nationwide |

| Steer Clear® Safe Driver | A- | 15% | State Farm |

| Good Student | B | 15% | Geico, State Farm, Progressive, Nationwide |

| Defensive Driving Course | B | 10% | State Farm, Progressive, Nationwide |

| Passive Restraint | B | 5% | State Farm, Progressive, Nationwide |

Progressive and Nationwide offer affordable SR-22 insurance in Washington through their usage-based programs. These programs offer 30-40% rate reductions for demonstrated safe driving.

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy, Good Student, Safe Driver, Defensive Driving Course, Anti-Theft Device, Loyalty, Generational | |

| Multi-Policy, Safe Driver, Good Student, Anti-Theft Device, Homeownership, Electronic Payment | |

| Multi-Policy, Good Driver, Defensive Driving Course, Good Student, Military, Emergency Deployment, Federal Employee, Vehicle Safety Equipment | |

| Multi-Policy, Multi-Vehicle, Safe Driver, Homeowner, Good Student, Pay-In-Full, Paperless Billing | |

|

Multi-Policy, Multi-Vehicle, Safe Driver, Defensive Driving Course, Anti-Theft Device, Paperless Billing, Automatic Payments |

|

Multi-Policy, Multi-Vehicle, Safe Driver, Pay-In-Full, Continuous Insurance, Good Student, Snapshot Program |

| Multi-Policy, Multi-Vehicle, Good Driver, Good Student, Defensive Driving Course, Anti-Theft Device, Safe Vehicle | |

| Multi-Policy, Safe Driver, Good Student, New Car, Hybrid/electric Vehicle, Pay-In-Full, Homeownership | |

| Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, New Vehicle, Family Legacy (children of Usaa Members), Low Annual Mileage | |

| Multi-Policy, Good Student, Safe Driver, Defensive Driving Course, Anti-Theft Device, Loyalty, Generational |

For cheap SR-22 insurance in Washington, USAA offers the lowest base rates, starting at $20 monthly, plus additional military-specific discounts. Beyond traditional discounts, drivers can reduce SR-22 insurance costs by bundling policies, completing defensive driving courses, or opting for higher deductibles.

data-media-max-width="560">Are you or do you know a senior driver? If you are looking to improve your driving while also saving money, consider taking a defensive driving course. Read all the ways you can save here! ➡️ https://t.co/5b0jmSJ8xd #OlderDriverSafetyAwarenessWeek #Seniors #Savings #Driving 👵 pic.twitter.com/e1a1OOV9CV

— Clearsurance (@clearsurance) December 8, 2021

Some providers like Farmers and Liberty Mutual offer payment flexibility with no-penalty monthly installments for SR-22 filing fees.

Washington SR-22 Insurance Requirements & Filing Process

The rates for SR-22 insurance in Washington depend upon the violation type and the provider. Liberty Mutual charges the most, while Progressive offers the cheapest. Other factors that determine SR-22 costs are age, location, credit score, and the kind of car you have.

Drivers will have to work directly with insurance providers to get SR-22 coverage, and there is a filing fee of $25-$50. The Washington Automobile Assigned Risk Plan is an alternative for those who cannot obtain traditional coverage. The table below shows Washington state's auto insurance risk factors and how they rank (based on industry standards) by grade.

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B | Slightly Below Average |

| Traffic Density | B | Moderate Traffic |

| Weather-Related Risks | B | Mild Climate |

| Vehicle Theft Rate | C | Moderate Theft Rate |

| Uninsured Drivers Rate | D | High Uninsured Rate |

On the other hand, drivers can avoid filing an SR-22 by depositing $60,000 in the State Treasury or purchasing a surety bond from a licensed agency.

Leading Washington SR-22 Insurance Companies

Nationwide leads Washington SR-22 insurance providers with the lowest filing fee of $15, followed by Progressive's unique 6-month rate reduction program and Allstate's digital compliance tracking app.

For SR-22 insurance in Washington, these companies stand out for their specific benefits that help high-risk drivers manage costs and maintain compliance.

Read More: Top 10 Car Insurance Companies for High-Risk Drivers

Remember that while price is important, choose a provider that offers robust filing support and electronic submission to the Washington Department of Licensing to ensure continuous coverage compliance during your three-year requirement period.

Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

How long do you need SR-22 insurance in Washington state?

Washington state requires drivers to maintain SR-22 coverage for three years from the reinstatement date of their license. Some providers offer programs to help reduce this period for safe driving.

Who needs SR-22 insurance in Washington?

Drivers must file SR-22 after DUI convictions, driving without insurance, license suspensions, multiple traffic violations, or at-fault accidents. Coverage requirements vary based on violation type.

Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

How do you file SR-22 documentation in Washington?

While SR-22 filing may seem complex, most providers handle it directly. Understanding what kind of car insurance you really need and how your driving record impacts coverage can help streamline the process.

Who provides SR-22 insurance?

Major insurers, including Nationwide, Progressive, and Allstate, offer SR-22 coverage with various programs and support options for high-risk drivers.

How much does SR-22 insurance cost?

Filing fees range from $15-50, while monthly premiums vary from $20-114 for full coverage, depending on your driving history and chosen provider.

Where is the cheapest place to get SR-22 insurance?

USAA offers the lowest rates, starting at $20 monthly for military members, while Progressive and Nationwide provide competitive rates. To find additional discounts, explore our guide on top ways customers save money on their car insurance.

How much is car insurance in Washington state?

Standard car insurance in Washington averages $70-150 monthly, while SR-22 coverage typically costs 90% more due to high-risk status.

Which company has the cheapest SR-22?

USAA offers the lowest SR-22 rates at $46 monthly for full coverage, followed by Progressive at $60 and Nationwide at $70.

What is an SR-22 used for?

SR-22 is a certificate of financial responsibility Washington state requires after serious violations. Learn more about what is liability car insurance and how it differs from SR-22 requirements.

Where can I get SR-22 insurance?

Purchase SR-22 insurance directly from licensed providers or compare quotes online. Most major insurers offer instant quotes and same-day DOL filing.

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.