Best and Cheapest Car Insurance in Florida for 2026 (Save Big With These 10 Companies!)

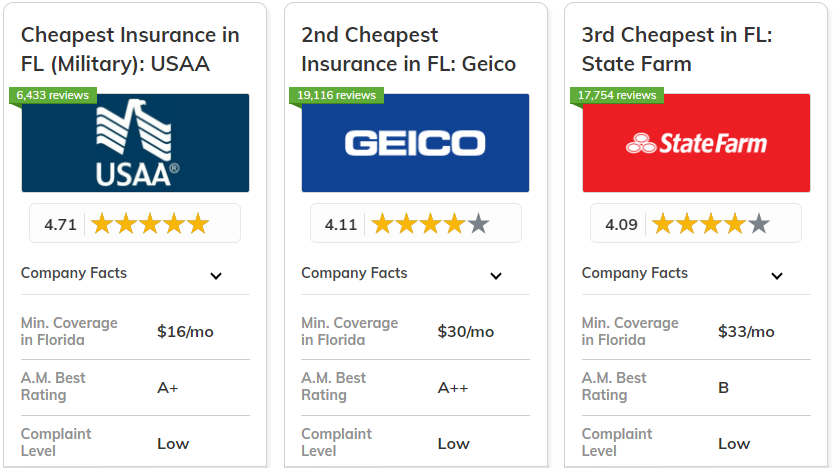

USAA, Geico, and State Farm have the best and cheapest car insurance in Florida.

Other great companies for cheap Florida car insurance are below.

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $16 | A++ | Military Drivers | USAA | |

| #2 | $30 | A++ | Cheap Rates | Geico | |

| #3 | $34 | B | Customer Service | State Farm | |

|

#4 | $35 | A | Multi-Policy Savings | Nationwide |

| #5 | $52 | A++ | UBI Discount | Progressive | |

|

#6 | $55 | A | Customizable Policies | Liberty Mutual |

| #7 | $56 | A+ | Coverage Options | Travelers | |

| #8 | $62 | A+ | Agent Network | Allstate | |

| #9 | $63 | A | Claims Service | American Family | |

| #10 | $76 | A+ | Various Discounts | Farmers |

Read on to learn more about finding the best and cheapest car insurance companies in Florida. You can also easily compare rates for Florida insurance with our free quote comparison tool.

On this page:

- Top Car Insurance Companies in Florida

- Cheapest Florida Car Insurance for Married Couples

- Cheapest Florida Car Insurance for Seniors

- Cheapest Florida Car Insurance for Teens

- Cheapest Florida Areas for Car Insurance

- Most Expensive Florida Areas for Car Insurance

- Florida Minimum Car Insurance Requirements

- Percentage of Uninsured Motorists in Florida

- How Florida Companies Calculate Car Insurance Rates

- How to Save on Florida Car Insurance

- How Clearsurance Ranks Florida Car Insurance Companies

- The Bottom Line: Buying the Best and Cheapest Florida Car Insurance

#1 – USAA: Top Pick Overall

Pros

- Military Drivers: USAA is the best Florida insurance company for military drivers and veterans.

- Customer Service: Read about USAA’s excellent scores for service in our review of USAA insurance.

- Bundling Discount: USAA also sells home insurance, which Florida residents can bundle with auto insurance for a discount.

Cons

- Restrictions on Eligibility: Eligibility for USAA insurance is restricted to Florida veterans, military members, and their families.

- Lacks In-Person Assistance: USAA mostly provides assistance through virtual platforms.

#2 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico has the cheapest Florida car insurance for non-military and non-veteran drivers.

- Platforms are User-Friendly: Florida drivers can easily check and change policy details on Geico’s app or website.

- Discount Opportunities: Florida drivers can apply for good student discounts, bundling discounts, and more. For example, you can bundle Geico renters insurance or home insurance with auto insurance to save.

Cons

- No In-Person Assistance: Geico’s assistance is provided through virtual platforms.

- New Car Coverage Options: Geico does not have as many options for new vehicles, such as gap coverage.

#3 – State Farm: Best for Customer Service

Pros

- Customer Service: The majority of customers are happy with the local agent assistance. Find out more about customer service in our State Farm insurance review.

- Discount Options: Florida customers can save with multi-policy discounts, good driver discounts, and other discount options.

- Coverage Options: Florida drivers can choose to buy several add-ons at State Farm.

Pros

- Limited Online Services: Online policy management is lacking at State Farm, as local agents assist with most services.

- Financial Rating: The company’s lower rating means State Farm could improve it financial management.

#4 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Savings: Florida drivers will get savings for buying multiple policies from Nationwide. Learn more in our Nationwide insurance review.

- Vanishing Deductible: Nationwide slowly reduces deductibles by up to $500 for claims-free Florida drivers.

- Flexible Coverages: Nationwide allows Florida drivers to adjust their coverages as needed.

Cons

- Customer Service Rankings: Nationwide’s customer service could have better rankings.

- Claims Filing: Some complaints about Nationwide note slower processing times.

#5 – Progressive: Best for UBI Discount

Pros

- UBI Discount: Progressive offers a UBI discount through Snapshot. Learn more in our Progressive Snapshot review.

- Innovative Tools: Progressive has free tools like Name Your Price that can help Florida drivers find the best coverage and rate for their needs.

- High-Risk Drivers: Progressive is one of the better companies for high-risk drivers in Florida.

Cons

- UBI Rate Increases: The disadvantage to Snapshot is that it may raise Florida auto insurance rates.

- Customer Rankings: Some rankings for customer services could be better.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Florida customers can customize coverages and other policy options.

- Online Platforms are User-Friendly: Florida drivers can use the website or app to change policy details, pay bills, and more.

- Discount Opportunities: Liberty Mutual has multi-policy discounts, good driver discounts, and other saving opportunities for Florida customers.

Cons

- Customer Rankings: Rankings could be improved. Learn more in our Liberty Mutual insurance review. * High-Risk Driver Rates: Florida drivers with multiple driving infractions will find Liberty Mutual a more expensive choice of insurer.

#7 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers coverage options range from basic coverages to special coverages like gap insurance.

- Financial Ratings: Travelers’ ranking for financial management is strong. Learn more in our Travelers insurance review.

- UBI Discount: Florida drivers can join IntelliDrive for a UBI discount.

Cons

* UBI Rate Increases: The danger of bad drivers joining IntelliDrive is that rates may increase.

- Customer Rankings: Rankings for services could be improved.

#8 – Allstate: Best for Agent Network

Pros

- Agent Network: Allstate’s representatives are available across Florida.

- UBI Discount: Allstate customers in Florida can join Drivewise. Learn more in our Allstate Drivewise review.

- Coverage Options: Allstate has plenty of choices for Florida customers.

Cons

- Customer Rankings: One of Allstate’s negatives is the lower customer satisfaction rankings.

- No Mile-Based Insurance: Florida doesn’t have Allstate Milewise for affordable, mile-based rates.

#9 – American Family: Best for Claims Service

Pros

- Claims Service: American Family’s claims service is rated highly by most customers.

- Coverage Variety: Florida customers can add on coverages for roadside assistance, new cars, and more. Learn more by reading our American Family insurance review.

- UBI Discount: American Family customers can save by joining the company’s UBI program.

Cons

- Basic Coverage Rates: American Family’s rates for minimum coverage can be higher than other companies’ rates.

- Limited Availability Outside Florida: You may not be able to keep the company as your insurer if you move outside of Florida.

#10 – Farmers: Best for Various Discounts

Pros

- Various Discounts: Farmers has discount variety for all types of Florida drivers. Learn more about discounts in our Farmers insurance review.

- Multi-Policy Discount: Farmers also sells home and renters insurance, which Florida customers can bundle with auto insurance.

- Widespread Availability: Farmers in available outside of Florida, so residents who move can keep Farmers as an insurer.

Cons

- Processing Times of Claims: Negative reviews talk about slow processing.

- DUI Rates: Florida drivers with a DUI or two will find Farmers one of the more expensive choices.

Top Car Insurance Companies in Florida

Finding the best and cheapest Florida car insurance for your specific needs can be confusing and difficult. You want to have peace of mind that your insurance company will follow through with its promises if you need to make a claim, especially if you're paying a pretty penny for what they charge for an annual premium.

Clearsurance is committed to collecting insurance company reviews and ratings from customers to highlight the best and cheapest car insurance companies in Florida.

With thousands of car insurance reviews from policyholders based on their individual experiences, Clearsurance provides reviews and rankings for hundreds of car insurance companies so that you can evaluate and compare.

Learn more: Car Insurance Shopping Guide

You might be surprised how often you can get the best auto insurance policy at an affordable price. Take a look below at how much coverage will cost you at the cheapest and best companies in Florida.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

|

$96 | $248 |

|

$63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

In the table above, you can sort through all of the best and cheapest car insurance Florida companies ranked on Clearsurance. The rating next to each company, the insurer's Clearsurance score, is based exclusively on the ratings provided by customers.

Note: Only those companies with at least 25 auto insurance reviews are eligible to appear in the best Florida car insurance rankings.

Are you interested in learning more about one of these Florida car insurance companies? You can visit the company's profile page to find out what additional level of coverage they offer, any discounts they offer and read car insurance reviews to learn from the experiences of other policyholders.

Once you've picked your top company, you can usually get a free quote directly from the company's website.

You can also use a quote comparison tool if you want to compare multiple companies rates at once.

Comparing the Cheapest Florida Car Insurance Companies

Let's assume you're buying collision coverage to protect yourself in an accident. If you go with the lowest rates with auto insurance coverage it'll obviously save you money each month. It may even allow you save the extra money you would've spent on more expensive rates and other, optional coverage that were required by other companies.

But what happens if you're involved in an accident? Do the companies refuse to pay? Do they take care of your claim efficiently?

Read more: Insurance Claims Rating for Top 10 Largest Car Insurance Companies

Insurance companies have to evaluate your accident and coverage before paying any claim. The cheapest companies are also industry giants, and they have entire teams dedicated to processing claims. Reviews are mixed, but in most cases, they seem to pay reliably and fairly.

Before judging a company based on their rates, look at their financial responsibility ratings; checking out their customer satisfaction rating couldn't hurt while you're at it. If it looks like they have a clean record of handling claims and complaints, they may be a good fit for you.

Cheapest Florida Car Insurance for Married Couples

USAA edged out Geico as the cheapest car insurance company for married couples in Florida among the top car insurance companies in the state.

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $68 |

| American Family | $79 |

| Farmers | $98 |

| Geico | $36 |

| Liberty Mutual | $68 |

| Nationwide | $42 |

| Progressive | $66 |

| State Farm | $40 |

| Travelers | $65 |

| USAA | $22 |

Of course, the numbers can change with more incidents or drivers who take advantage of more insurance discounts. The cheapest and best car insurance companies for married couples hinge on many factors.

Cheapest Florida Car Insurance for Seniors

Curious how rates vary for senior drivers? Take a look at the average rates below.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $226 | $223 | |

| $161 | $163 | |

| $194 | $194 | |

| $112 | $112 | |

|

$239 | $243 |

|

$158 | $160 |

| $156 | $147 | |

| $120 | $120 | |

| $136 | $138 | |

| $82 | $82 |

For many senior drivers in Florida, USAA also provides the cheapest average car insurance rates out of the best Florida car insurance companies by market share, followed by Geico as the second cheapest.

To discover the best car insurance for senior drivers based on your requirements, read individual company profiles and reviews for more detail.

Cheapest Florida Car Insurance for Teens

The average rate for coverage is going to vary with the age of the driver. Teenagers are often looked at as high-risk drivers, because of their lack of driving history, which means they will sometimes see higher payments when buying new driver car insurance.

Among the best car insurers in Florida, USAA is the cheapest car insurance company for teen drivers, followed by Geico.

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $868 | $910 | |

| $590 | $726 | |

| $1156 | $1103 | |

| $425 | $445 | |

|

$1031 | $1121 |

|

$586 | $679 |

| $1144 | $1161 | |

| $444 | $498 | |

| $1026 | $1298 | |

| $349 | $356 |

Adding collision and/or comprehensive insurance could change these rates significantly. A clean driving record also comes with much different rates as compared to a driver who has multiple tickets or accidents.

Cheapest Florida Areas for Car Insurance

Just as your location can affect your auto policy payments, so can your ZIP code. Car insurance rates in the state of Florida vary significantly based on cities and neighborhoods.

Read more: How to Get Cheap Car Insurance

On average, the cheapest car insurance can be found in the areas of Archer, Micanopy, Newberry and Waldo, all tied as the cheapest car insurance rates in Florida.

| Area | Monthly Rates |

|---|---|

| Waldo | $153 |

| Archer | $153 |

| Micanopy | $153 |

| Newberry | $153 |

| Alachua | $153 |

| La Crosse | $153 |

| Gainesville | $154 |

| Earleton | $154 |

| Freeport | $156 |

| Santa Rosa Beach | $156 |

In the table above, you can see the top ten cheapest areas in Florida for car insurance based on average rates for single adults.

Most Expensive Florida ZIP Codes for Car Insurance

Car insurance in Florida can be expensive, depending on the area. The cost of car insurance varies by neighborhood in Florida cities as a result of varying crime rates and the frequency of accidents or other claims.

Learn more: Why is car insurance so expensive?

The most expensive area for car insurance in Florida is Opa-Locka, but Miami Gardens isn't far behind.

| Area | Monthly Rates |

|---|---|

| Opa-Locka | $308 |

| Miami Gardens | $305 |

| Hialeah | $298 |

| Miami | $296 |

| North Miami Beach | $295 |

| Homestead | $295 |

| Key Biscayne | $292 |

| Hallandale | $287 |

| Dania | $283 |

| Tampa | $280 |

The table above displays the top 10 most expensive areas in Florida for car insurance based on average rates for a single adult.

Florida Minimum Car Insurance Requirements

In order for Floridians to drive legally, the state requires residents to buy the minimum coverage amounts for property damage liability and personal injury protection (PIP) liability insurance. The good news for Florida residents is that the state's required minimum coverage limits are lower than most states.

However, it may not be wise to simply purchase minimum coverage to save money. If you only purchase the minimum requirements with the smallest limit of liability coverage, it doesn't cover your damages in a big accident when you're at fault.

Read more: What is liability car insurance?

If you are at fault and the other party suffers more costly medical bills than your policy covers, they or their insurance company may go to court to satisfy that amount.

Florida state minimum requirements:

Liability:

- Property damage — $10,000 per accident

Personal injury protection:

- $10,000 per person

Property damage liability in Florida provides coverage in the event that you damage someone else's property in a car accident. This is most commonly another vehicle, but also includes other items such as a home or a fence.

Personal injury protection (PIP) provides coverage for any medical expenses or income loss that result from a car accident. It also provides coverage, up to the policy's limits, for family members in the vehicle and for a few other situations.

Florida's No-Fault State Requirements

Florida is a no-fault insurance state. This means that your Florida insurance company is responsible for covering you in the event of a car accident, regardless of who caused the accident. This makes it especially important for you to have the necessary car insurance coverage to protect yourself in the event you are injured in a car crash, even if it means paying for a higher overall annual premium.

Additionally, drivers in no-fault states typically can't sue the other driver for pain and suffering (barring severe injuries that meet a certain threshold). This means that your personal injury protection (PIP) and health insurance will be responsible for covering all the associated costs.

Again, if you only have the state minimum coverage and the other party's injuries are much more significant, you could still be at risk.

Please note that laws in the state of Florida don't require you buy bodily injury liability. If you opt to buy this coverage, the minimums are $10,000 per person and $20,000 per accident.

Percentage of Uninsured Motorists in Florida

Uninsured motorist coverage may seem unnecessary given that Florida is a no-fault state. After all, why should it matter to you if the other driver has insurance if your company is responsible for your injury claims anyway?

In most accidents, uninsured motorist coverage wouldn't be needed. However, if you are involved in a car accident that results in serious injuries that allow you to sue the other driver, there may not be any money to collect if the at-fault driver is uninsured.

Learn more: Steps to Handling an Accident with an Uninsured Driver

It's worth noting that the state Florida is notorious for having uninsured drivers. Florida's percentage of uninsured drivers is 26.7, the highest of any state in the United States, according to 2015 data from the Insurance Information Institute. By comparison, the national average in 2015 was 13 percent.

How Florida Companies Calculate Car Insurance Rates

It can be frustrating trying to understand how your insurance rates are calculated when searching and comparing quotes from the best and cheapest auto insurance companies in Florida. You may also find that you can pay either a monthly or an annual rate.

While there is no exact formula that each car insurance company uses when providing you a quote, there are many factors that do contribute to the price you pay for your insurance.

Among the factors that car insurers consider are:

- Your driving record

- How much you drive

- Location

- Age

- Marital status

- Gender

- Your car’s make, model and year

- Your credit history

- Amount of car insurance coverage (required coverage and optional add-ons, such as collision and comprehensive)

There are many misconceptions about how insurance works. Even Florida's no-fault law is often misconstrued. One of the major pain points for drivers is the fact that your location affects your insurance rates. Why should you have to pay more if you have a clean driving record and you've worked hard to avoid poor credit?

Learn more: How does my credit score affect my insurance premium?

Unfortunately, being in certain high crime or high accident areas makes you a greater risk. Even if you're the safest driver in the world, you can't always control the drivers around you. An insurance company's risk calculation has to account for this. Even when they can recover the money they paid you for a claim, there are administrative and sometimes legal costs to consider.

How to Save on Florida Car Insurance

We'd all like to have the best coverage at affordable prices from one of the best and cheapest Florida car insurance companies. While you would never want to sacrifice quality to save a couple of dollars, there are some different ways that you can lower your car insurance premium.

One of the first steps is to check for car insurance discounts at the cheapest Florida insurance companies.

Here are six other ways you may be able to lower your car insurance rates:- Bundle your car insurance with other policies (home insurance + car insurance)

- Consider raising your deductibles

- Pay your car insurance policy in full

- Try usage-based car insurance (pay-per-mile car insurance)

- Monitor price changes to your policy

- Shop for better insurance rates

Following the above steps should help most drivers lower their rates (learn more: Top Ways Customers Have Saved Money on Car Insurance Rates).

How Clearsurance Ranks Florida Car Insurance Companies

Consistent with its mission towards greater transparency, Clearsurance does not keep its rating and ranking formulas in a black box. Our algorithm analyzes a range of inputs from our independent community of insurance customers, including:

- Price

- Customer Service

- Claim service

- Likelihood to renew

The algorithm also takes into account the percentage of what customers say the company does well (strengths) compared to the percentage of what customers say the company could do better (opportunities).

Finally, there is also a confidence factor based upon the number of reviews a company has by product. If there are fewer than 100 reviews, Clearsurance reduces the 'confidence' in the star rating. This is most impactful when there are fewer than 25 reviews for a company.

Read more: How to Get Cheap Car Insurance

Companies with 100 or more reviews, aged two years or less, receive 100% weighting (no deduction), while companies with 50 to 99 customer reviews receive a weighting of 95%, 25 to 49 reviews receive a weighting of 90% and companies with less than 25 reviews a weighting of 85%.

This is how we can recommend some auto insurance companies with confidence. Affordable car insurance combines your monthly premium with the amount you pay during the year for any claims. So reliability is a major factor in our rankings of insurance providers.

Learn more: How to Buy Car Insurance

Large companies like Allstate, State Farm, and Geico are able to maintain low rates without sacrificing service. Depending on the person, though, local companies sometimes offer a greater insurance discount. This is why it's important to get multiple insurance quotes when you're shopping.

The Bottom Line: Buying the Best and Cheapest Florida Car Insurance

Whether you're buying your insurance direct or going through an agent, understanding the different car insurance coverage options is a must. There is still such a wide range of questions out there that a driver may have.

Do you know what is covered by comprehensive coverage? Are you familiar with uninsured motorist coverage? Do you know how a deductible works?

Clearsurance wants to ensure you’re equipped with a proper knowledge of car insurance, so check out Clearsurance's car insurance guide. Looking for more educational information about car insurance? Check out Clearsurance's car insurance blog for more information and topics related to car insurance.

Ready to shop for affordable Florida auto insurance rates today? Enter your ZIP code into our free tool to find cheap Florida quotes.

| Facts | Details |

|---|---|

| Founders | Francois de Lame, Jennifer Fitzgerald |

| Founded | 2014 |

| Headquarters | PO Box 758648, Topeka, Kansas 66675-8648, US |

| What They Offer | olicygenius is an online insurance tech company that specializes in providing life, home, and auto insurance. |

| Employees | 279 |

| Revenue | $355.2 million |

| Phone | (855) 695-2255 |

| geniushq@policygenius.com |

Frequently Asked Questions

Who offers the most affordable rates for teen drivers in Florida?

Among the four largest car insurers in Florida by market share, USAA is the cheapest car insurance company for teen drivers. If you want to obtain an even lower annual rate for your teen drivers, check with your provider if they offer any discount for students, or have them take a defensive driving course.

Who offers the most affordable coverage for a married couple in Florida?

USAA is the cheapest car insurance company for a married couple in Florida among the four largest car insurance companies in the state. It may not seem like it, but sometimes the cheapest option you may be given will be if you mention that you're married.

Who offers the most affordable options for senior drivers in Florida?

For senior drivers in Florida, USAA provides the cheapest average car insurance rates out of the four largest Florida car insurance companies by market share.

What is the best insurance for cars in Florida?

Full coverage is the best insurance for most cars in Florida.

Who has the lowest auto insurance rates in Florida?

USAA has the lowest Florida auto insurance rates.

Why is Florida auto insurance so high?

Florida car insurance is expensive due to several factors, such as higher coverage limits, uninsured drivers, and more.

Does Florida require full coverage auto insurance?

No, Florida doesn't require drivers to carry full coverage. However, lenders do require customers to carry full coverage.

What is the most basic car insurance in Florida?

The most basic policy in Florida will be the required minimum liability policy.

Do I need car insurance in Florida?

Yes, driving without insurance in Florida is illegal.

Is Florida an expensive state for car insurance?

Yes, Florida is one of the more expensive states for car insurance.